ATO Client Accounts

How the ATO runs its client accounts is a mystery to most people. Let’s see if we can’t simplify the subject for you.

Having trouble? We can make it easy for you to manage your ATO client accounts, and get your tax filings accepted by the ATO. Contact us for a free consultation

What are ATO client accounts?

ATO client accounts are accounts for taxes, other than income tax – such as business profits or employee salaries.

They are also used by the ATO to track your business’s tax payment history and identify any outstanding debts.

The ATO has many different types of client accounts.

- Income Tax Account

- Integrated Client Account (renamed to “Activity Statement Account” in ATO’s online services)

- HELP or similar (student loan account)

- Insolvency Account

- Legal Account

- SGC Account

In our experience, no one really understands them all.

Part of the problem is some ATO staff may use some of these terms differently/interchangeably.

The ATO also changes their policies with regards to your tax statement regularly.

So it can be confusing if you don’t know what all the accounts are meant for.

What do all these different ATO client accounts do?

Today we will focus on the two primary accounts, which affects most individuals.

Income Tax Account

Every individual and company (we know of) has one of these.

This account has 3 purposes

- Debiting what you owe the ATO for income tax per your tax return. (The income tax account are normally only affected by Tax Return lodgements)

- Refund from the ATO after lodging your tax returns, and claiming deductions

- Penalties for failure to lodge, or interest on late payments

A note on penalties: The ATO is often willing to work with you if you show you’re trying to make amends. If you get these charges, always contact us as there are many grounds for remission (forgiveness).So contact us if you get any of these penalties and we can seek out grounds for remission (forgiveness) on your behalf.

Integrated Client Account or Activity Statement Account

You will have one of these accounts if you have:

- Non-salary income

- Goods and Services Tax

- Employee Pay-As-You-Go withholding

Non-salary income

Non salary income is income you receive from investment or business income.

Because this income is not withheld by your employer, you have to pay it as Pay-As-You-Go (PAYG) income tax installments.

PAYG taxes are calculated based on the asset’s worth and affected by individual circumstances. The ATO relies on the last lodged income tax return to calculate this commitment.

Therefore, if you have large changes in your non-salary income you can end up with an inaccurate amount.

If this happens, you could be paying too much tax. Get in touch and we can show you ways of paying only what you owe.

The amounts you pay via PAYG are credited against your next tax return in the same way any employee tax withheld is treated.

Goods and Services Tax (GST)

You probably already know what GST is.

You collect tax on behalf of the government and pay it to the government.

Any GST you pay is credited against collections.

Employee Pay-As-You-Go withholding

If you employ staff, you must deduct this tax from their salaries and remit it to the government.

We hope this simple overview clarifies ATO client accounts and what you need to do.

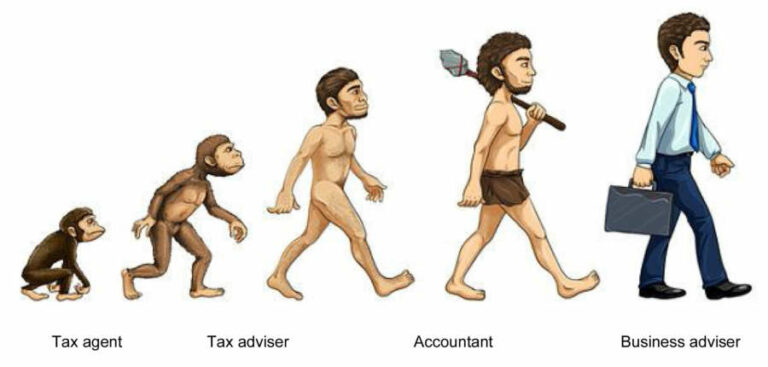

If you have any queries on this subject, speak to any of our technical staff on why you have a particular transaction on one of your accounts. We are Brisbane based tax advisers, contact us on 07 3483 0100.